The Importance of a Forex Trading Journal

In the fast-paced world of Forex trading, every decision you make can significantly impact your financial results. Maintaining a forex trading journal MetaTrader5 Trading journal is an essential practice that can lead to enhanced trading performance. A trading journal not only helps you keep track of your trades but also allows you to reflect on your decisions, analyze outcomes, and refine your trading strategies over time.

What is a Forex Trading Journal?

A Forex trading journal is a record of all the trades you make, including detailed information such as entry and exit points, trade size, the reasoning behind each trade, and the psychological state during execution. This documentation supports a disciplined approach to trading.

Why You Need a Trading Journal

Many traders underestimate the importance of maintaining a trading journal. However, here are some compelling reasons to keep one:

- Performance Tracking: By regularly documenting your trades, you can analyze your performance over time and identify patterns that can lead to success or areas in need of improvement.

- Psychological Insights: Trading is as much a psychological endeavor as it is a technical one. A journal helps you reflect on your emotions before, during, and after trades, enabling you to understand how these emotions influence your decision-making.

- Strategy Refinement: With a record of your successful and unsuccessful trades, you can refine your trading strategies, learning from what works and what doesn’t.

- Accountability: A trading journal holds you accountable for your decisions, encouraging discipline in your trading approach.

Elements of a Successful Trading Journal

To create an effective Forex trading journal, consider including the following elements:

- Trade Date: The date and time of the trade.

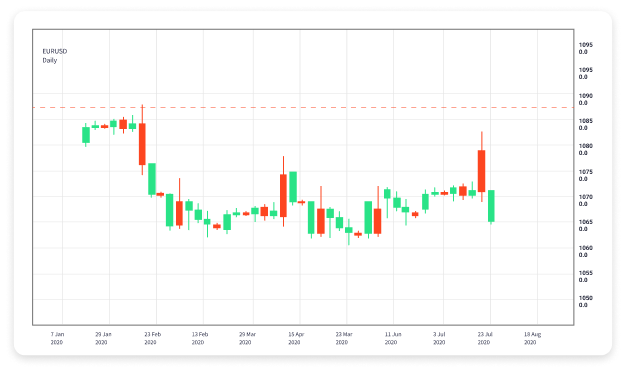

- Currency Pair: The pairs you traded (e.g., EUR/USD, GBP/JPY).

- Trade Direction: Indicate whether the trade was a buy or sell.

- Entry and Exit Points: Record the price levels at which you entered and exited the trade.

- Trade Size: Note the size of your position (in lots).

- Stop Loss and Take Profit Levels: Document your risk management parameters.

- Reason for Trade: Write down your analysis and rationale for entering the trade.

- Emotional State: Reflect on your feelings and thoughts during the trade.

- Outcome: Analyze the trade results, including profit or loss.

- Lessons Learned: Summarize key takeaways from each trade.

Tips for Maintaining Your Trading Journal

Keeping a trading journal can be daunting, especially when juggling multiple trades. Here are some tips to make the process easier:

- Consistency is Key: Make it a habit to update your journal immediately after each trade, ensuring accuracy and completeness.

- Use Technology: Consider using digital tools or applications designed for trading journals, which can simplify record-keeping.

- Review Regularly: Schedule regular reviews of your journal to identify trends and insights. Weekly or monthly reviews can be particularly beneficial.

- Stay Honest: Be truthful in your assessments, including mistakes made and emotional responses. This honesty will provide more valuable insights for improvement.

Conclusion

In conclusion, a Forex trading journal is a vital tool that can help you become a better trader. By recording your trades and analyzing your performance, you can uncover valuable insights, improve your strategy, and ultimately enhance your trading results. Begin the practice today, and watch how it transforms your trading journey.

Remember, effective trading is not just about winning; it’s about learning from each experience and continuously improving. So take the time to invest in your future by maintaining your trading journal.